Confidently prepare HMDA LAR data for HMDA Plus

Grant Thornton's HMDA data integrity services provide institutions with a more efficient way to review Home Mortgage Disclosure Act (HMDA) loan application register (LAR) data.

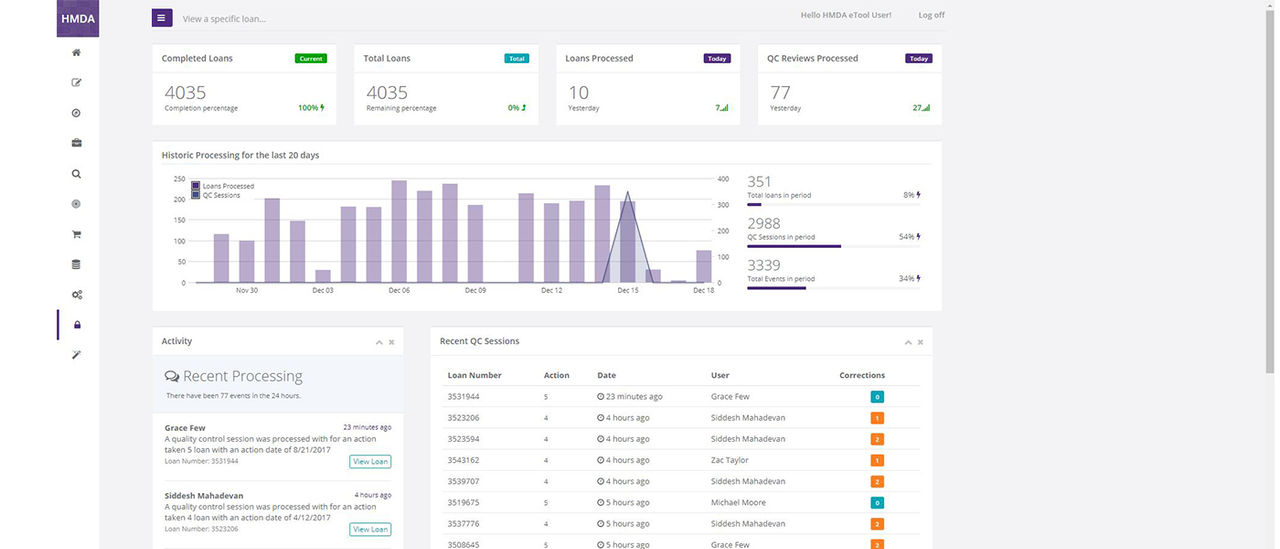

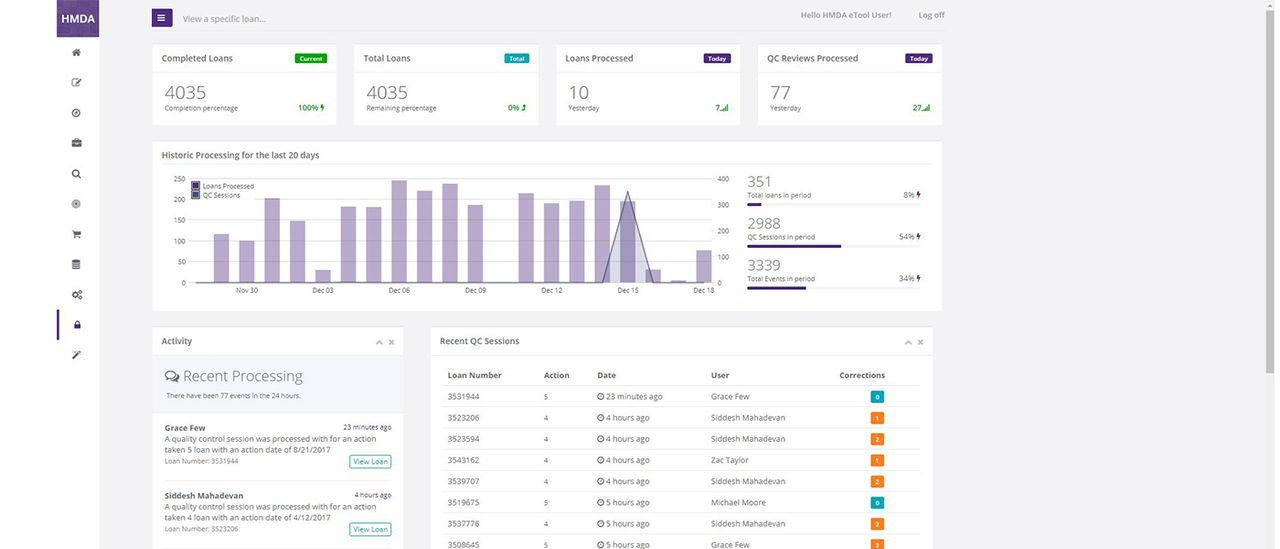

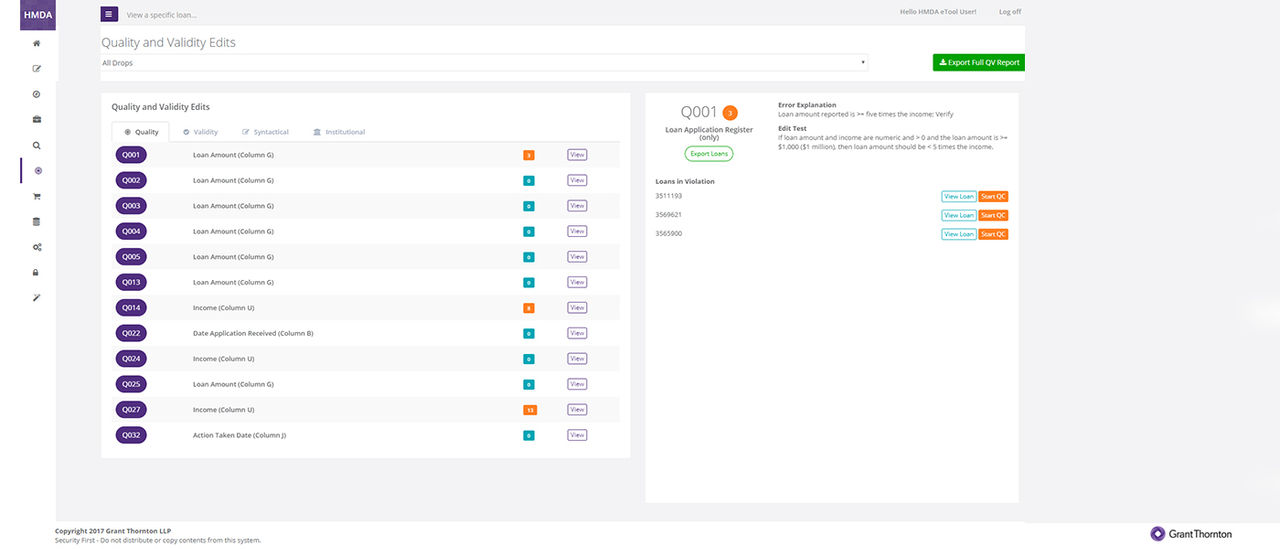

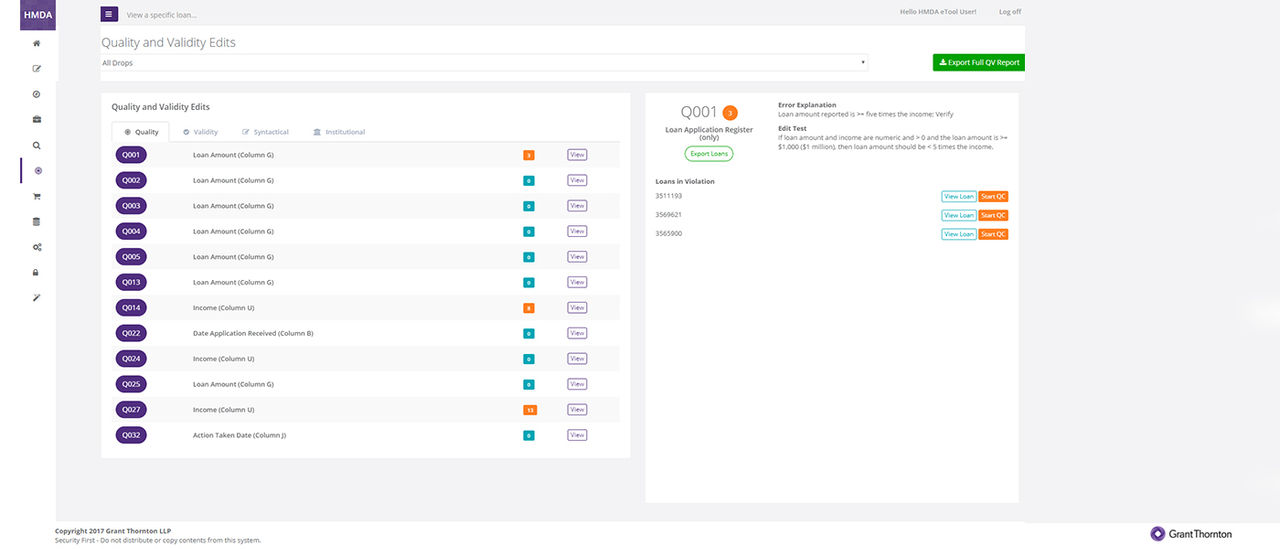

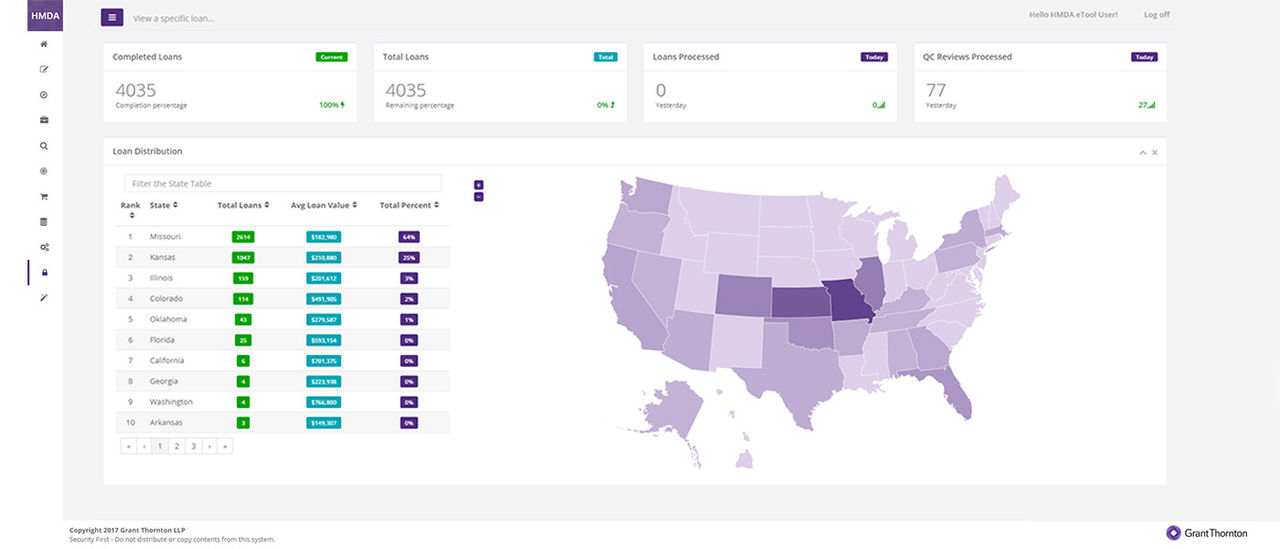

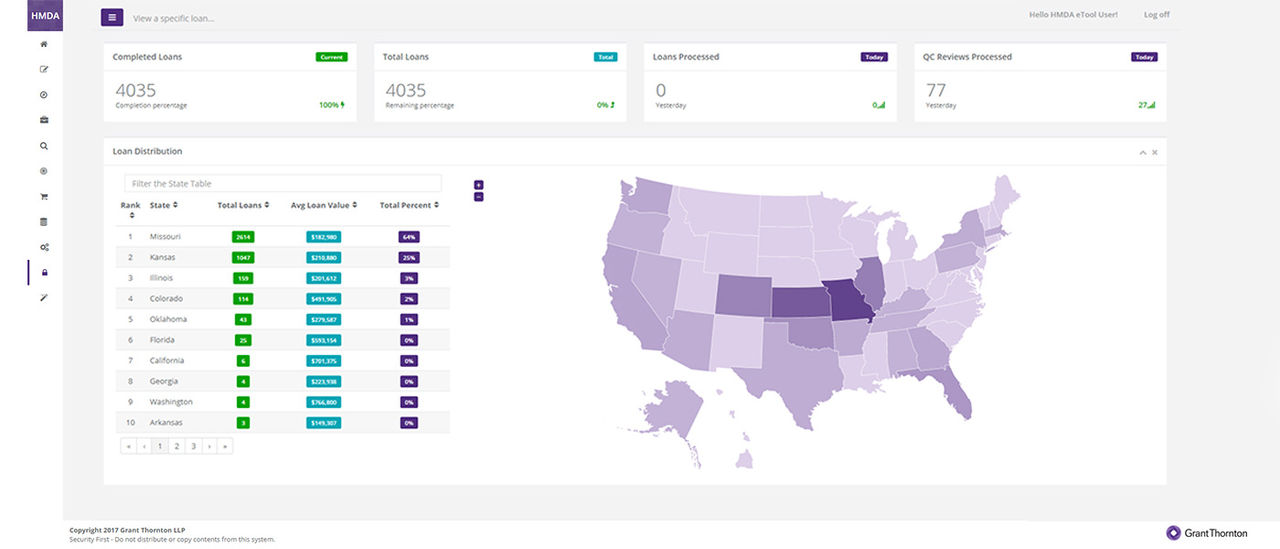

Replace the cumbersome process of reviewing your LAR data within multiple spreadsheets with the HMDA eTool an advanced, user-friendly application designed to enable teams to seamlessly collaborate, cleanse, and validate LAR data. The result is a clean LAR file, ready for you to confidently send for final submission.

Use of the HMDA eTool or provision of related services is subject to Grant Thornton LLP’s internal client acceptance procedures, including clearing independence and conflicts of interest inquiries.

The HMDA eTool

Helps those responsible for Home Mortgage Disclosure Act reporting have more confidence in the data they are submitting in their LAR register.

Want to get your HMDA LAR data right, quickly?

WHICH IS RIGHT FOR YOU?

SaaS or full service, which is right for you?

Stop using spreadsheets and manual processes: Lending institutions that have processes and audit professionals in place to review their HMDA LAR data and perform data scrubbing can automate their reviews by licensing the HMDA eTool for Software as a Service.

WHICH IS RIGHT FOR YOU?

Full-service data validation services

Rely on our financial services and regulatory knowledge, HMDA Plus experience, and technology expertise: Institutions struggling to adjust to HMDA Plus can license the technology and leverage a scalable, experienced team to help with all HMDA LAR data scrubbing and validation activities, with services tailored specifically to your institution. For some companies, shifting data validation to an external company creates efficiencies, which can decrease compliance costs while also improving the quality of the submitted data.

Contact us to learn about

Saas and Full Service

Partner, Technology Modernization Services

Grant Thornton Advisors LLC

Zac Taylor is a Principal within Grant Thornton’s Organizational and Operational Transformation practice.

Dallas, Texas

Industries

- Asset Management

- Banking

- Life Sciences

- Technology, Media & Telecommunications

- Manufacturing, Transportation & Distribution

- Construction & Real Estate

Service Experience

- Advisory Services

- Operations and Performance