The first quarter of 2023 finds businesses confronting a slew of tax and business challenges. Rising interest rates and inflation continue to plague the economy, and many companies are already girding for a potential recession.

The legislative outlook won’t make it any easier. The shift in power from the November elections is setting the stage for a debt limit showdown that could have broader implications for federal policy and the economy. Planning for these challenges should include an analysis of the tax implications, especially as the tax landscape itself continues to shift underfoot.

Congress’s failure to enact a broad year-end tax deal means some companies face new limits on deductions for investments in capital and research. At the same time, the ability to deduct interest on the debt used to finance these activities has changed. Businesses must also grapple with significant new tax provisions from the Inflation Reduction Act (IRA), often with little help from the IRS, as it races to provide guidance. The largest companies face a new minimum tax based on book income, while a new excise tax on stock buybacks will apply more broadly to public companies and M&A activity. Multinationals should be assessing the impact of new foreign tax credit rules and keeping an eye on the progress abroad toward implementing the global tax agreement, which could affect transfer pricing. Given the IRS’s huge boost in funding, enforcement action is likely to ramp up on all these issues and more.

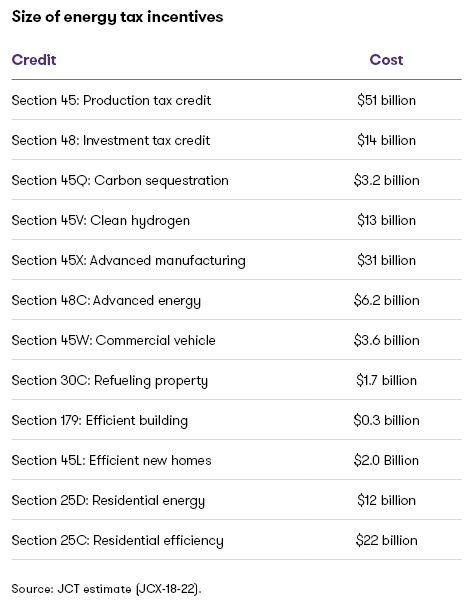

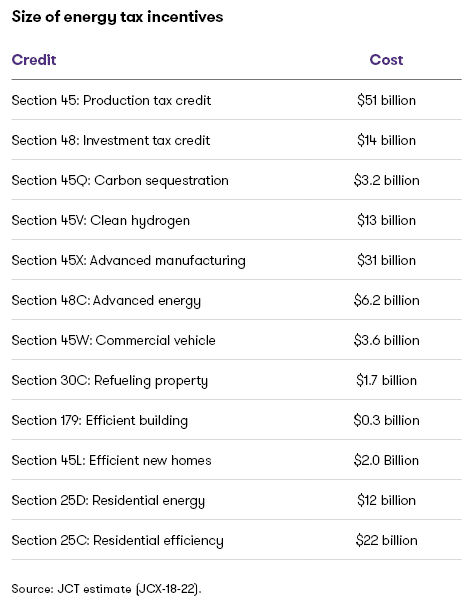

There are new opportunities as well. A nearly $300 billion package of energy incentives offers significant benefits across a wide variety of sectors, including traditional energy, renewables, technology, manufacturing, and any business with a focus on environment, social, and governance (ESG) initiatives.

Taxpayers should be proactively seeking solutions, and tax departments have to be more forward-looking than ever. This is the ideal time to look at how data transformation and analytics can free the tax function to focus on strategy.

The first step to forming a tax strategy should be understanding which issues will have the most impact. This guide is meant to help businesses and investors identify their top tax considerations for 2023, which could include:

- R&E amortization – Congress last year failed to restore expensing for research and experimentation (R&E) costs, and many companies are scrambling to assess the impact of amortizing these costs for 2022 financial statements and returns.

- Public stock buyback tax – Public companies with stock buyback programs, M&A activity, and stock compensation plans are racing to understand the impact of a new 1% tax on redemption transactions in 2023.

- Minimum book tax – A new corporate alternative minimum tax (CAMT) based largely on financial statement income will affect large multinationals with more than $1 billion in adjusted financial statement income.

- Capital investment and debt financing – Congress last year failed to address many important expiring and expired tax provisions, meaning bonus depreciation will be reduced for property placed in service in 2023 and more companies could face limits on their interest deductions on 2022 returns.

- Energy credits – The Inflation Reduction Act extended, enhanced, and created almost $300 billion worth of energy incentives, offering benefits for the renewable sector, traditional energy, and many other businesses with high energy needs or ESG initiatives.

- Transfer pricing – Changing global tax rules and continued supply chain disruptions will keep transfer pricing the top tax issue for many multinationals, with advance pricing agreements growing in popularity.

- Technology transformation – Technology tools keep improving every year, making this is a perfect time to look at how data automation, data transformation and analytics can make tax workflows faster and easier.

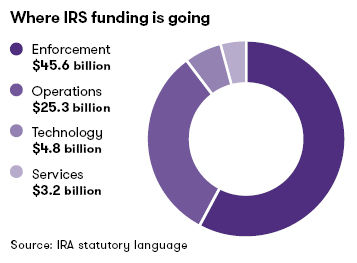

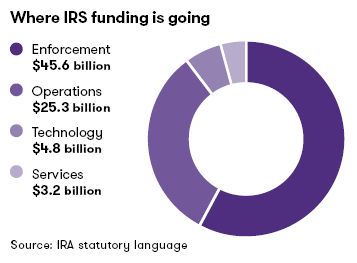

- IRS funding – The administration has an unprecedented $80 billion in new funding that will allow it to transform how taxpayers interact with the IRS and dramatically increase enforcement activity.

- SALT deduction workaround – An increasing number of states have enacted regimes allowing pass-through business owners to avoid the $10,000 cap on state and local tax deductions by electing to be taxed at the entity level.

- Estate and gift planning – Rising interest rate and economic volatility have made transfer tax planning more challenging.

Many of these issues require immediate action, especially those that need to be addressed on 2022 tax returns or first-quarter interim period financial statements and estimated tax payments for 2023. The top 10 planning considerations for 2023 are discussed in more detail below.

R&E amortization

Research investment represents a significant expense in many industries, including manufacturing, technology, and the life sciences. Under a change effective for tax years beginning in 2022 and later, domestic R&E costs under Section 174 must be amortized over five years instead of being expensed. Since a mid-year convention must be used, this effectively allows companies to deduction only 10% of domestic R&E costs in 2022. Foreign R&E must be amortized over 15 years under the new rules.

Many companies waited to do the hard work of identifying these costs in hopes of a legislative fix. Unfortunately, 2022 ended without a deal. While Congress could resurrect negotiations, any action would generally be too late for 2022 financial statements. Amortization may create a significant book-tax difference and deferred tax asset for companies with deep R&E investments. This also has the potential to impact effective tax rates if a valuation allowance is required for the deferred tax asset or due to the indirect effects on other calculations, including the interest expense limitation under Section 163(j), the base erosion and anti-abuse tax (BEAT), global intangible low-taxed income (GILTI), or foreign-derived intangible income (FDII). Even more significantly, the reduced deduction could push some companies from a net operation loss position into taxable income, which can have a cascading effect on other tax attributes.

Given the hurdles to legislation, businesses should also be assessing the impact to their 2022 tax returns and 2023 planning. Significant effort may be required to properly identify the research costs covered under Section 174, which is much broader than the definition of research for the R&D credit. The R&D credit requires activities to meet a “process of experimentation” and a “technological in nature” test, while R&E activities under Section 174 must only meet an “uncertainty” requirement. Section 174 also requires the inclusion of all costs incident to the research, including indirect costs such as rent and depreciation, and all costs related to the development of internal software. The R&D credit only allows for wages, supplies, and contract research expenditures. In addition, taxpayers can no longer choose to capitalize and amortize R&E costs over 10 years under Section 59(e) and will not be able to take advantage of the various options for deducting software development costs previously available under Rev. Proc. 2000-50.

There may be opportunities to mitigate the impact. Businesses can consider whether certain costs remain deductible under Section 162, though this could have implications for the R&D credit calculation. Multinationals should also consider the impact on foreign subsidiaries, branches and partnerships because amortization can affect GILTI-tested income and other U.S. taxable income determinations.

Public stock buyback tax

Public companies face a new 1% excise tax on the fair market value (FMV) of stock repurchases beginning in 2023. The tax applies to corporations with stock traded on an established securities market, which includes corporations with stock that is traded on a national securities exchange. A repurchase is defined for this purpose as a redemption under Section 317(b), plus “economically similar” transactions. The tax could increase costs on many kinds of common redemption activity, including redemptions related to M&A and stock compensation plans. The new excise tax is not deductible for income tax purposes.

Under initial guidance from the IRS, the tax will cover a variety of corporate transactions, including acquisitive reorganizations, certain E and F reorganizations, and exchanges in some split-off transactions. The tax can also apply to redemptions of non-publicly traded stock, such as preferred stock, if the corporation has other stock traded on an established securities market.

There are important exceptions and exclusions. Stock issued effectively reduces the amount considered repurchased for purposes of calculating the tax. There are specific rules for determining the FMV of stock issued and repurchased. In addition, the following repurchases are excluded:

- Reorganizations within the meaning of Section 368(a) where no gain or loss is recognized

- Contributions to an employer-sponsored retirement plan, employee stock ownership plan, or similar plan

- Repurchases if aggregate FMV does not exceed $1 million

- Repurchases by a dealer in securities in the ordinary course of business

- Repurchases by a regulated investment company (RIC) or a real estate investment trust (REIT)

- Repurchases to the extent treated as a dividend

The IRS has said the tax will be remitted and reported annually with the Form 720 for the first quarter after the end of the year, meaning the 2023 tax and form would be due by April 30, 2024. This is no reason to wait to understand the impact. For one, the tax may need to be assessed for financial statement purposes each quarter in the period incurred. So some public companies may need to understand the tax impact of first quarter transactions by the end of April. More importantly, there might be opportunities to mitigate the tax.

Different types of transactions can be treated differently for the tax. Some M&A transactions can give rise to a large increase of a tax base if they are recharacterized as a repurchase, so the tax should be considered as a part of transaction planning and structuring. Because stock issued by a corporation may offset stock repurchases during the year, companies should consider the timing of repurchases related to their stock issuances. Any excess of stock issuances cannot be carried forward and used against stock repurchases in future years.

Minimum book tax

The IRA created a new 15% corporate alternative minimum tax (CAMT) effective for tax years beginning after 2022. The tax is expected to affect a narrow set of the largest multinationals, but for those companies, the CAMT will be transformative and significantly impact income tax compliance. The CAMT represents a major departure from traditional taxing norms because it relies heavily on financial statement income.

The tax will generally apply to an “applicable corporation” that has average adjusted financial statement income (AFSI) exceeding $1 billion over a three-year period. Domestic subsidiaries of foreign corporations will be subject to the CAMT if the global group exceeds the $1 billion threshold (with certain adjustments) and the group has $100 million or more of AFSI from the U.S.

The calculation of AFSI starts with net income from the applicable financial statement, and then applies specific adjustments, which include taxes, tax depreciation, and certain earnings of controlled foreign corporations and pass-through entities. There are many other important statutory adjustments, and Treasury has broad authority to add additional adjustments. The IRS’s initial guidance provided potentially complex rules that will disregard any recognition of book gain or loss for CAMT purposes for specified nonrecognition transaction, including tax-free reorganizations.

The amount of any CAMT will be the amount that 15% of AFSI exceeds regular tax, and this incremental tax can be used as a credit against the CAMT in future years. Companies that could be affected should assess and model the impact now. The tax’s reach could be broader than expected, as there are several aggregation rules for determining whether a company exceeds the $1 billion threshold. The IRS guidance does provide a safe harbor for companies with less than $500 million in unadjusted financial statement net income.

Capital investment and debt financing

The failure of Congress to act on a year-end tax extender deal leaves in place two unfavorable changes that could affect deductions for interest expense and tangible business investments. These changes could prompt companies to reassess their financing structures and capital investment plans.

The change to the limit on interest deductions under Section 163(j) became effective for tax years beginning in 2022 and thereafter. Section 163(j) generally limits the deduction for net interest expense to 30% of adjusted taxable income. Before 2022, adjusted taxable income was similar to earnings before interest, taxes, depreciation, and amortization (EBITDA). For tax years beginning in 2022 and later, depreciation and amortization must be included, lowering adjusted taxable income for purposes of the limit.

This change could prove particularly painful with interest rates rising. Interest expense on variable rate debt is likely to increase but will is now less likely to be deductible. Businesses with substantial interest expense should consider the impact of the change when evaluating current and future financing arrangements.

Bonus depreciation is also becoming less favorable for property placed in service in 2023. For the last several years, bonus depreciation allowed businesses to deduct 100% any property with a useful life of useful life of 20 years or less under the modified accelerated cost recovery system (MACRS). This included both used property any qualified improvement property, which includes almost any improvement to a building interior that doesn’t enlarge or affect the structure of the building or its elevators. Property placed in service in 2023 now only qualifies for 80% bonus depreciation, and without legislative action, that rate will decrease to 60% in 2024 with additional drawdowns in future years.

Congress could still consider retroactive changes to both of these tax increases, but significant hurdles remain. Companies should be assessing what the current rules mean for their business planning, financial statements, and tax returns.

Energy credits

The IRA should usher in a new era of energy investment. The tax title makes energy incentives more accessible and valuable than ever before. There are credits and deductions available for a wide variety of activities that benefit taxpayers across nearly every type on entity and industry. The new and enhanced incentives include:

- Sections 45 and 48: The tax credits for renewable energy include credits for wind, solar, and geothermal property that are valuable to both the renewable industry and ordinary companies with high energy needs or ESG initiatives. The increased credit rates and the added eligibility for microgrid controllers and energy storage also make smaller projects more viable than ever. The credit for combined heat and power systems can benefit manufacturers.

- Section 45Q: The carbon oxide sequestration credit offers increased credit amounts for capturing and permanently sequestering carbon emissions. It is a potential boon for many oil and gas extraction companies, refiners, power plants, chemical companies, the steel industry, brewers and distillers, paper producers, concrete makers, and many other types of manufacturers with carbon emissions.

- Section 45V: The clean hydrogen credit offers a credit on sliding scale for producing hydrogen with reduced greenhouse gas emission. It should help power plants, refineries, and chemical companies pursue new projects.

- Section 45X: The advanced manufacturing credit will for the first time offer manufactures of wind, solar, and battery components a credit at their stage in the domestic supply chain. Producing certain minerals will also be eligible for a credit.

- Section 48C: The advanced energy property credit will allow taxpayers to apply for a piece of a new $10 billion allocation for a wide variety of qualifying projects. Manufacturers of renewable energy equipment, energy storage systems, carbon capture equipment, clean vehicles and infrastructure, grid modernization property, critical minerals, and other conservation technologies may be eligible. Manufacturers who commit to re-equipping a facility to reduce emissions by 20% can also apply.

- Section 179D: The energy-efficient commercial building deduction can help any business building out space deduct rather than capitalize up to $5 per square foot in costs for energy efficient HVAC, doors, windows, roofing and insulation.

- Section 45L: Residential homebuilders and property developers can claim a credit for energy efficient new homes.

- Clean vehicles and infrastructure: Businesses with commercial fleets may be able to benefit from a new commercial clean vehicle credit under Section 45W. It doesn’t suffer from the same battery and mineral sourcing restrictions as the consumer clean vehicle credits. Taxpayers can also receive a credit under Section 30C for putting EV charging stations and other alternative fuel refueling property in service.

- Consumer credits: Homeowners will benefit from credits for clean energy and energy-efficient investments in their homes under Sections 25C and 25D, which will also benefit the manufacturers of solar equipment and many types of energy-efficient appliances and building materials.

The incentives can be monetized more easily than ever before, and will be valuable even to companies without tax to claim a credit against. The credits under Sections 45Q, 45V and 45X are fully refundable for five years, while the rest may be sold to unrelated parties for cash. Tax-exempt entities can also generally claim any of the credits as refundable payments.

There is an important catch. To fully benefit from the credits, taxpayers will generally be required to meet new prevailing wage and apprenticeship requirements. Initial IRS guidance indicated that there may be substantial burdens identifying the correct wages and documenting compliance.

The credits rules can be complex. Some offer different options for claiming and monetizing them, and there are restrictions on claiming more than one credit. Taxpayers should carefully assess the availability and model out the potential benefits of various projects and credit elections.

Transfer pricing

Transfer pricing has rarely been more difficult thanks to rising interest rates, supply chain disruptions, sweeping international tax law changes, and increased global reporting requirements. Transfer pricing has also never been more important.

The growing exposure involved with transfer pricing issues is matched only by how pervasive it is. Multinationals are required to determine an arm’s length transfer price for any cross-border transaction or agreement between related parties, including for goods, services, intangible property, rents and loans. This represents a staggering amount of activity. According to the U.S. Census Bureau, 42.6% of all imports and exports are between related parties, and this doesn’t even include intercompany services, loans, or payments for intangibles.

The amount of tax at stake can also be substantial. The largest tax disputes in U.S. Tax Court history involve transfer pricing, with judgments reaching billions of dollars in taxes and penalties. The IRS has been successful in its recent litigation and is stepping up enforcement. These efforts will be aided both by $80 billion in new IRS funding and new international tax agreements. The Base Erosion and Profit Shifting (BEPS) initiative from the Organisation for Economic Cooperation and Development (OECD) is continuing to drive legislative changes worldwide that will continue to impose new rules and reporting for transfer pricing.

The costs of a transfer pricing dispute can go beyond the adjustments in tax and the potential 20% and 40% penalties for valuation misstatements. Transfer pricing issues are notoriously complex and disputes are difficult to resolve – resulting in sizeable costs in professional fees and in-house resources. Due to the cross-border nature of the issue, all transfer pricing disputes involve at least three parties affected by the outcome: the taxpayer and both countries affected by a change in transfer price.

The size, complexity and ambiguity of transfer pricing issues, combined with the involvement of at least two countries, makes for a complicated and expensive resolution process. Alternative dispute resolution programs are increasingly popular, and include administrative appeals, mutual agreement procedures, international compliance assurance program (ICAP), and advance pricing agreement programs (APAs). Effective use of these programs takes careful planning and requires understanding the interests of and standards applied by all the parties involved.

Multinationals should also continue to monitor new guidance of the OECD global minimum tax agreement and new rules for foreign tax credits.

Technology transformation

Tax departments are under tremendous pressure to do more with less. Tax laws are changing at a historic pace while a volatile economic climate is driving major business changes. Tax accounting and compliance together require significant investments in resources, and the tax industry is not immune to widespread workforce shortages.

There may be opportunities to dramatically improve both efficiency and product. Many tax departments at even the most sophisticated businesses are still dedicating most of their time to basic number crunching and repetitive processes. Tax functions may rely heavily on Excel spreadsheets, experience poor or nonexistent integration between data sources and workpapers, or employ redundant data gathering for different uses.

Automation and data transformation and analytics could be the solution. Most companies could benefit from a holistic analysis of their processes and functions to understand where they have weaknesses and risks, and where automation and analytics could be the most helpful. The difference between manual data preparation and automation can be seconds versus hours. Automated tax engines and tools can drive startling efficiencies for managing income taxes as well as indirect taxes like value added taxes and sales and use taxes.

Automated data transformation and analytics can also be a valuable tool for all tax types, including income tax and provisions preparation, sales and use taxes, and property tax. Once data is prepared, visualization can help businesses see into the data and manage the tax function by noting exceptions and anomalies, instead of hunting for the story manually. This can help tax departments prepare data in a faster, better way for tax deliverables, audit support, reports and presentations. It drives efficiency in the process, accuracy and risk reduction in reporting, and immediate visibility into the tax and finance functions of the business.

IRS funding

The IRS of tomorrow will look vastly different from the IRS of today. The IRA provided an unprecedented $80 billion in extra funding that should lead to transformational changes to the agency over the next several years. This special allocation represents more than six years of annual appropriations based on recent IRS funding levels. Plus, the money comes on top of regular annual funding with no restrictions on when it can be spent.

Hopefully the funding will help the IRS update its technology and improve taxpayer services, which have suffered after years of underfunding, increasing administrative responsibilities, and COVID-19 workforce challenges. But much of the funding is also earmarked for enforcement. The statutory language of the IRA directs the IRS to spend no less than $45.6 billion on enforcement, with only $34.4 billion going to technology, operations, and taxpayer services.

Taxpayers should expect significant enforcement increases, with the uptick in examinations and collections leading to substantial additional taxes for all types of taxpayers and businesses. Nonpartisan congressional scorekeepers estimated that the new funding would lead to $200 billion in new tax revenue over the next 10 years, making the provision quietly one of the largest revenue raisers in the IRA.

Significant new audit activity will be directed at high-income individuals and partnerships, where audit rates declined the most in recent years. The centralized partnership audit rules under the Bipartisan Budget Act of 2015 will make the IRS more effective in performing audits on complex partnership issues and enforcing adjustments. Other types of taxpayers, including large corporations, should also expect increasing audit activity. The IRS doesn’t have to make as many tough choices between competing priorities. It can afford to dedicate resources across all its enforcement activities.

The increases in enforcement activity will not be immediate. The IRS will need time to perform hiring and update its technology and processes. But it won’t take as long as many might be hoping. The IRS has been hiring furiously for the last two years. Its workforce grew by more than 5,000 full-time equivalents between 2019 and 2021, and the pace has only picked up since. The IRS now has direct-hire authority and can onboard applicants more quickly than ever before.

Republicans have criticized the massive IRS funding increase, and many have pledged to claw it back. Any change in IRS appropriations, however, must pass the Democratic-led Senate and be signed by President Joe Biden. This will make funding reductions very difficult over the next two years. Taxpayers should ensure they are properly supporting and documenting return positions, and be especially aware of the issues where the IRS is directing specific enforcement activity.

SALT deduction workaround

Pass-through entities (PTEs) are benefitting from growing opportunities to help their owners work around the $10,000 cap on the federal state and local tax (SALT) deduction. To date, 29 states and one locality have enacted regimes that allow pass-through businesses to deduct SALT taxes at the entity level in exchange for a credit or exemption from state tax on the pass-through income of owners. This allows a business to fully deduct state tax for federal purposes against the distributive share of owner income, rather than having owners pay tax and take a limited SALT deduction at the individual level.

The explosion in state regimes over the last two years came partly in response to IRS guidance (Notice 2020-75) confirming the viability of the entity-level deductions. Although these regimes can offer significant benefits to pass-through business owners, there are potential drawbacks. Whether electing into a PTE tax ultimately makes sense is a complex determination that depends on a variety of factors.

The lack of uniformity among state laws presents particular challenges. State rules vary on when taxpayers can make an election to shift tax to the entity level. The timing of an entity-level deduction may depend both on when the election is made and when the entity makes payments for the tax. State laws also vary (and are not always clear) on whether PTE taxes paid in one state are creditable against other PTE regimes or personal income tax liability in other states.

It’s also important to understand that PTE elections may benefit certain partners more than others, particularly for PTEs operating across many states or with partners residing in different states. These pass-through businesses should weigh the burdens of paying the entity-level tax against the benefits of passing the entity-level deduction to partners, and also consider whether the partnership agreement will permit any necessary adjustments to allocations or distributions. States are still updating their laws to address technical considerations. Pass-through businesses considering the election should carefully analyze the most current state laws and fully assess the potential implications.

PTE regimes are far from the only major SALT consideration. Important SALT developments over the last year also include state tax rate reductions that can provide planning opportunities, sales tax inventory nexus litigation targeting past activity, and important market-based sourcing developments that could dramatically affect the calculation of state corporate-level tax liability. See our full article for the top SALT issues of the past year.

Estate and gift planning

Transfer tax planning has been upended over the last two years by inflationary pressure and interest rate changes. This is no reason to panic. Transfer tax planning is a lifelong process and should evolve to accommodate changes in personal circumstances, tax laws and the broader economic climate.

Inflation has the potential to affect succession planning in important ways. The most obvious is the impact inflation will have on asset values and future appreciation. Estate planning typically involves “freeze” strategies, which remove future appreciation of an asset from the estate. It’s critical to understand the impact inflation may have on the appreciation of different types of assets. It is very inefficient to transfer an asset that loses value. Taxpayers should consider which assets may weather or even profit from an inflationary environment and which assets typically suffer in these periods.

It’s equally important to consider the impact of interest rates. Many freeze strategies hinge on the ability of assets to appreciate faster than interest rates prescribed by the IRS. The rate in Section 7520 used to determine the present value of annuities and remainders has risen significantly over the last two years. Taxpayers should assess the impact to planning and what future rate changes could mean for specific strategies.

Taxpayers should also remember the current favorable estate, gift, and generation-skipping transfer tax lifetime exclusions, which reached $12.92 million in 2023, are scheduled to be cut in half in 2026 without any new legislation. The IRS has issued helpful guidance allowing taxpayers to leverage the current exemptions without fear of future changes clawing back the benefit. The rules provide that the estate tax can be determined using the exemption amount allocated to gifts made during the increased exemption period or the exemption amount at the time of death, whichever is greater. Taxpayers who do not take advantage of the increased exemptions with gifts before 2026 could forfeit the benefit of the increased exemptions. See our full story for succession planning in the current environment.

Next steps

Taxpayers should immediately begin addressing the planning considerations that must be reflected on 2022 tax returns. It may also be important to act quickly on planning opportunities for 2023 and beyond. The earlier tax planning is built into business planning, the more effective it is. Several 2023 issues may need to be resolved before first quarter estimated tax payments and financial statements are due.

Contacts:

This content supports Grant Thornton LLP’s marketing of professional services and is not written tax advice directed at the particular facts and circumstances of any person. If you are interested in the topics presented herein, we encourage you to contact us or an independent tax professional to discuss their potential application to your particular situation. Nothing herein shall be construed as imposing a limitation on any person from disclosing the tax treatment or tax structure of any matter addressed herein. To the extent this content may be considered to contain written tax advice, any written advice contained in, forwarded with or attached to this content is not intended by Grant Thornton LLP to be used, and cannot be used, by any person for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code.

The information contained herein is general in nature and is based on authorities that are subject to change. It is not, and should not be construed as, accounting, legal or tax advice provided by Grant Thornton LLP to the reader. This material may not be applicable to, or suitable for, the reader’s specific circumstances or needs and may require consideration of tax and nontax factors not described herein. Contact Grant Thornton LLP or other tax professionals prior to taking any action based upon this information. Changes in tax laws or other factors could affect, on a prospective or retroactive basis, the information contained herein; Grant Thornton LLP assumes no obligation to inform the reader of any such changes. All references to “Section,” “Sec.,” or “§” refer to the Internal Revenue Code of 1986, as amended.

Trending topics

No Results Found. Please search again using different keywords and/or filters.

Share with your network

Share