What your company should know about the IPO alternative

A special purpose acquisition company, or SPAC, presents opportunities for private companies to go public, usually without the heavy lifting associated with an IPO and with less dilution that leads to higher valuation.

A SPAC works by raising capital to join with a private company and then go public. Once publicly listed, the funds raised remain in a trust while the SPAC looks for acquisition targets — usually, a private company. Management generally has two years to identify a target company. Once a SPAC identifies an acquisition target and completes the deal, the SPAC no longer exists, and the newly joined company trades under a new ticker symbol. If they make no acquisition during the two years, the trust dissolves and investment money returns to the investors.

SPACs have been occurring sporadically over the last 30 years, but recently there has been a surge in the number of SPACs. According to data compiled by NASDAQ, there were 34 SPACs in 2017, 46 in 2018 and 59 in 2019. In 2020, the number exploded to 248, accounting for more than half of all IPOs. In 2021, we may see as many as 100 more each month.

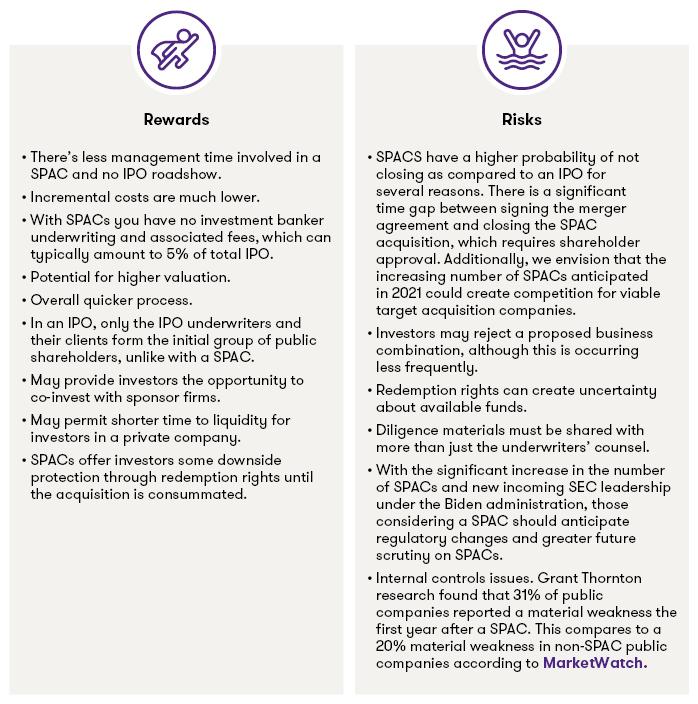

If your company is considering a SPAC opportunity, there are many things to contemplate. Begin by taking a high-level look at potential rewards and risks:

Discussion items

The four points below provide additional considerations and questions to discuss with management if a SPAC might be in the cards for your company:

- Due diligence. You will need to hold an organizational meeting, perform due diligence and develop data room protocols. You will also need to arrange for vendors to perform buy-side financial and operational diligence and assess the results of normalized financial operations or other diligence results with the investment committee.

- Structuring the deal. How much equity (or debt) will be purchased or deployed? How will the consideration be structured (i.e., cash, debt or equity)? Who will retain control of company? You will need to structure any earn-outs, communicate to public (i.e., Form 8-K), obtain shareholder approval and select investment advisors such as bankers and lawyers to facilitate structuring of the deal.

- Target readiness. You will need to be certain that all financial statements and operations are ready for scrutiny. This would include corporate governance/Sarbanes-Oxley requirements, general financial reporting, and tax, human resources and IT issues. Identify remediation areas prior to integration with the SPAC and subsequent public company reporting.

- Consummate the transaction. You will execute a merger or acquisition agreement, file form 8-K or any pro forma financial information as needed, analyze any business combinations and reporting issues, and file subsequent Forms 10-K and 10-Q with appropriate disclosure of acquisition.

There are a significant number of factors to weigh in determining whether a SPAC is the best avenue for your company, so be sure you’ve looked at every angle.

For more pragmatic insights, visit our Boards and audit committees page.

Trending topics

No Results Found. Please search again using different keywords and/or filters.

Share with your network

Share